Seal The Deal: Two sides with one goal … to get promising companies funded

Seal the Deal brought together an enterpreneur, VC and attorney to show how term sheet negotiation REALLY works.

HighTechXL can help with that.

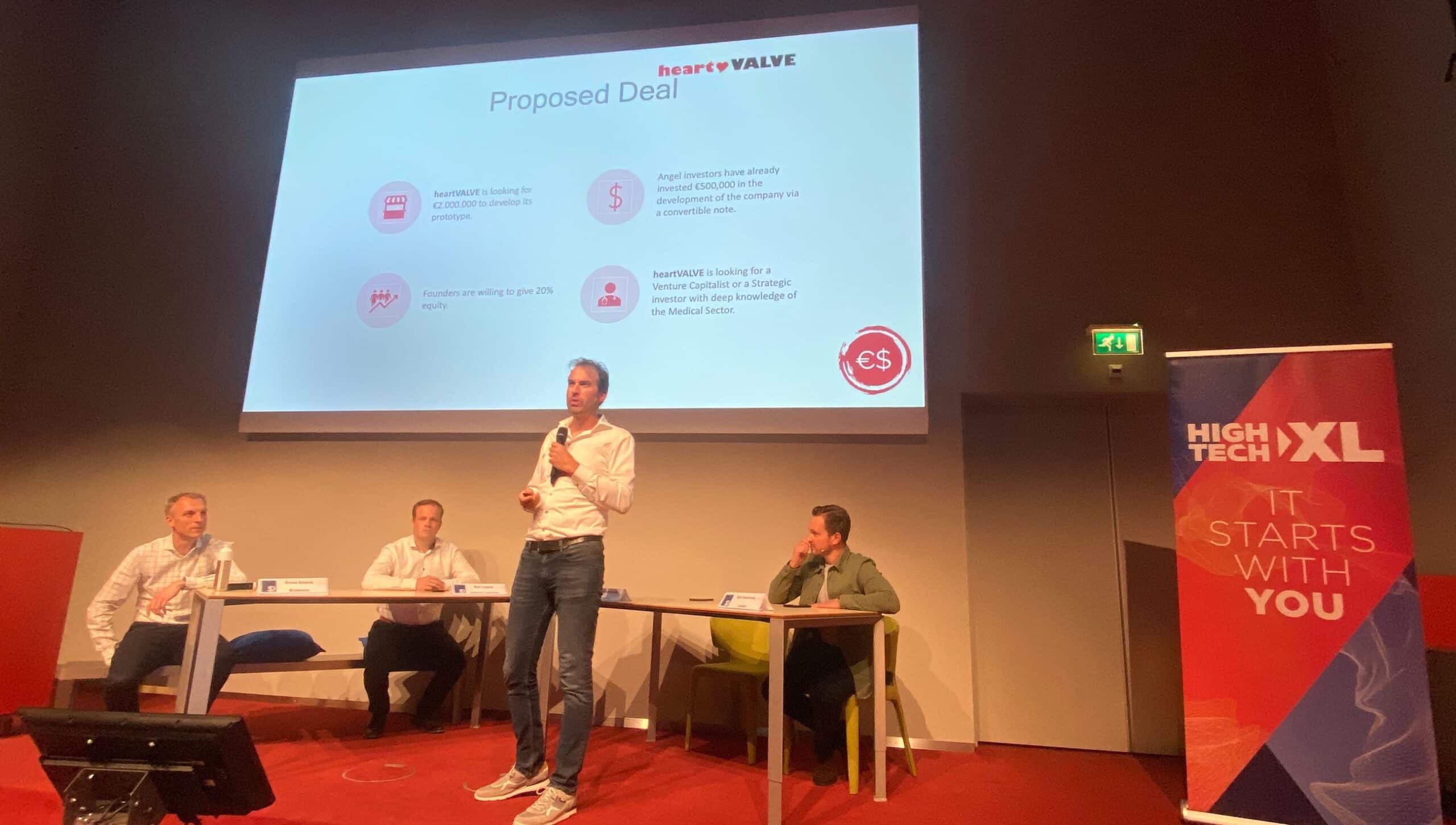

For Seal the Deal on 1 June at High Tech Campus Eindhoven, we brought together a venture capitalist (Bart Lugard, DeepTechXL), M&A attorney (Bart Hesemans, ;blatter), dealmaker (Broos Bakens, entre.ventures) and our own Chief Growth Officer Boudewijn Docter playing a role he knows well to create a whole term sheet process that can lead to investment.

In the presentation, Boudewijn played the founder of a startup HeartValve in negotiation with Bart Lugard for a Series A investment round up to 10 million euros. While the 90-minute negotiation was civil, it was fraught with issues that were not easily resolved. Just like in the real world.

Playing the founder, Boudewijn, with guidance from Bart Hesemans, did what he’s done in the past as the founder of EFFECT Photonics … he asked a lot of questions when he didn’t understand some of the more arcane terms or agree with what seemed to him egregious demands from Bart the VC.

The presentation included:

• the valuation … how the VC and the founders agree on the abstract value of a company that has no revenue

• liquidation preferences, or who gets what if the company is sold or dissolved

• antidilution, the protection for investors should the startup have to raise more money at a lower valuation

• drag along and tag along, the rights VCs have when it comes to selling the company or to bringing in new investors

• good leavers, bad leavers and early leavers, which determines whether founders leaving the startup keep or lose their shares

One major point of contention was whether VCs should impose milestones, with the panel agreeing that for the most part, no startup in the history of the world has ever reached them.

One item Boudewijn took issue with as the founder was the founder vesting and lockup clause, rewarding the team by gradually returning to them the equity they had at the beginning as they achieve milestones.

“This is a very strange one for us,” Boudewijn said. “Now it seems I have to earn back my company. This feels emotional.”

But Bart the VC assured him the clause was necessary to make sure critical personnel continued with the startup.

In the end, both sides – the VC and the founders – gave a little bit and reached a deal, a realistic outcome.

Of course, not everything can be neatly quantified, and emotions and personality come into play. Which was just fine with our VC.

“The whole discussion is a psychology test, not just about deal details,” Bart said.

About HighTechXL

HighTechXL is the Netherlands’ premier deep-tech venture builder, solving societal challenges by combining groundbreaking technologies and entrepreneurship. We bring together and activate technology, talent, funding and a strong ecosystem in our unique Venture Building Program.

News